The Crucial Role of Cash Flow Forecast Reports in Project Success

When it comes to managing a project, financial stability is key. Without a clear understanding of the project’s cash flow, businesses risk encountering costly obstacles and potential failure. This is where the importance of a cash flow forecast report shines. By accurately predicting and analyzing the movement of funds, businesses can make informed decisions, mitigate risks, and ensure project success. In this blog post, we will delve into the significance of cash flow forecast reports and explore how they contribute to effective project management.

✅ Planning for the Future:

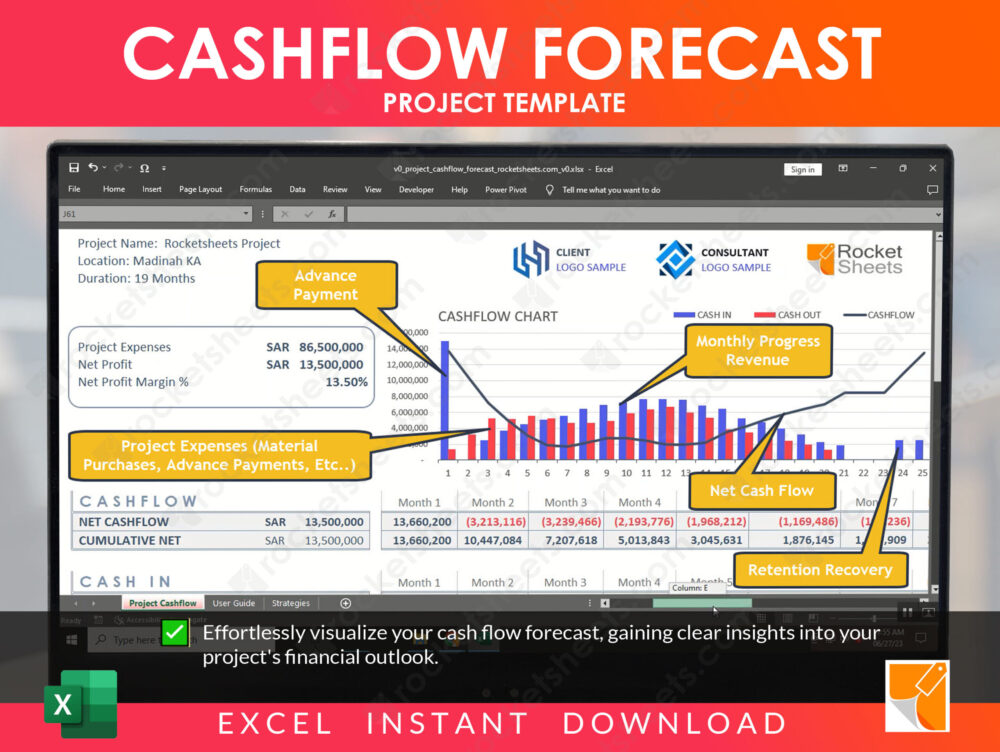

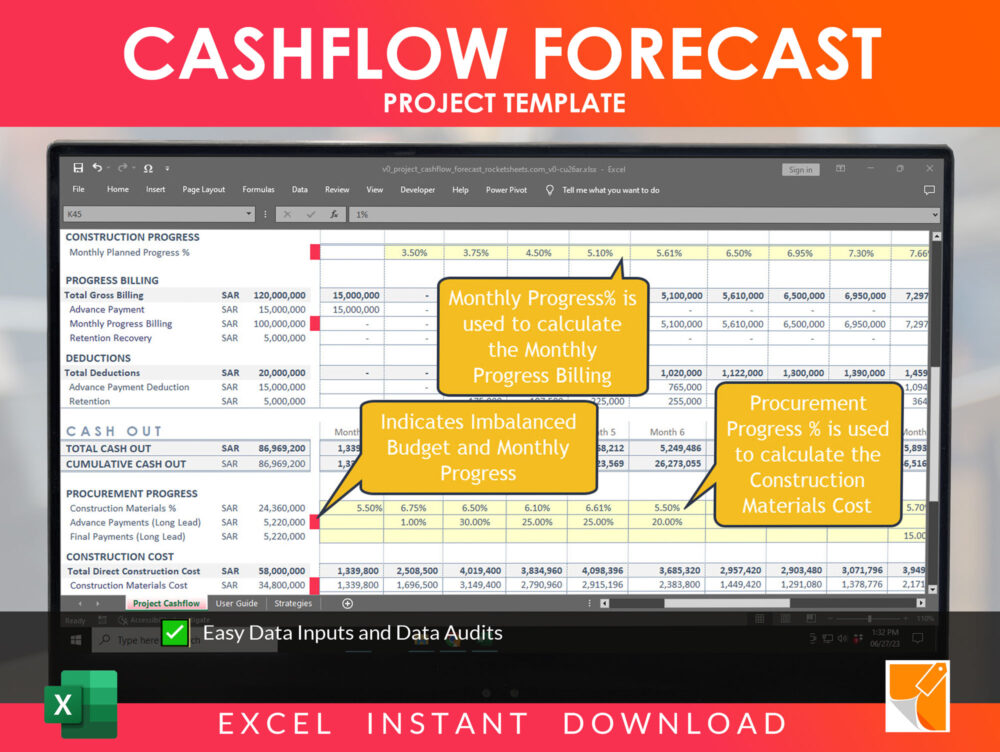

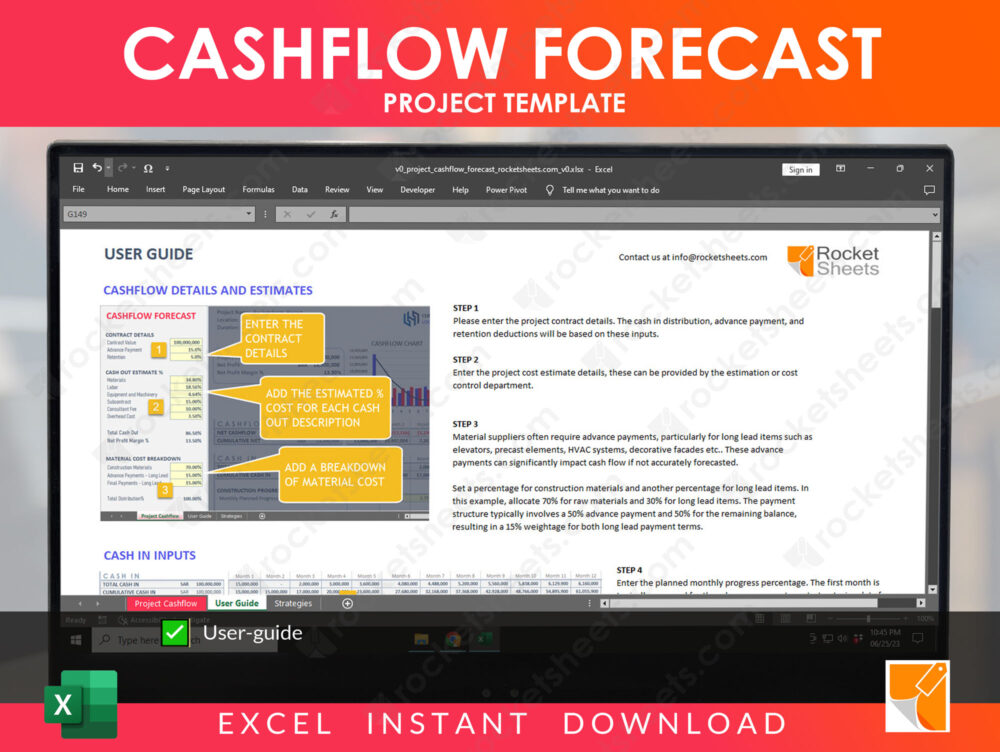

Cash flow forecast reports provide a glimpse into the financial future of a project. By estimating the inflow and outflow of funds, businesses can anticipate potential shortfalls or surpluses, allowing for proactive planning. This valuable insight enables decision-makers to allocate resources wisely, adjust budgets, and secure additional funding if necessary. With a clear financial roadmap in place, projects can proceed smoothly and confidently.

✅ Managing Cash Flow:

Effective cash flow management is crucial for the smooth operation of any project. Cash flow forecast reports allow businesses to monitor and control their finances by tracking income and expenses. This helps identify potential cash flow gaps, enabling proactive measures to bridge the shortfall. By having a real-time overview of cash flow, businesses can make informed decisions on payment schedules, prioritize expenses, and ensure timely payments to suppliers, contractors, and employees.

✅ Mitigating Risks:

Unforeseen financial challenges can significantly impact project timelines and deliverables. Cash flow forecast reports act as a risk management tool by highlighting potential bottlenecks and financial risks. By identifying periods of low cash reserves or excessive outflows, businesses can take preventive actions such as securing additional funding, renegotiating payment terms, or adjusting project timelines. Proactive risk management helps maintain financial stability and ensures project continuity.

✅Building Investor Confidence:

Investors and stakeholders are keenly interested in the financial health of a project. Cash flow forecast reports provide transparency and credibility, demonstrating a well-planned financial strategy. When potential investors have access to accurate cash flow projections, it instills confidence and trust in the project’s financial viability. This, in turn, increases the likelihood of securing funding and attracting additional support for the project’s success.

✅ Adapting to Changing Circumstances:

Projects rarely proceed exactly as planned. Unexpected events, such as delays, unforeseen costs, or market fluctuations, can disrupt cash flow patterns. Cash flow forecast reports provide the flexibility to adapt to changing circumstances. By continuously monitoring and analyzing cash flow, businesses can identify deviations from the original forecast and adjust strategies accordingly. This agility ensures that projects can navigate uncertainties and maintain financial stability throughout their lifecycle.

Conclusion:

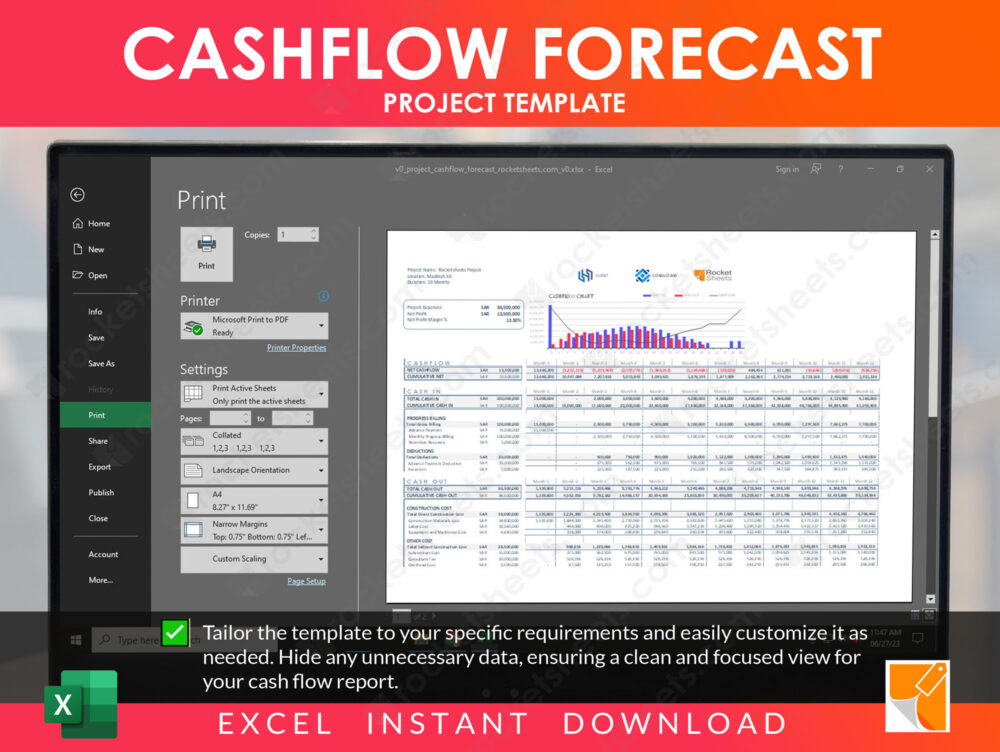

In the realm of project management, the significance of cash flow forecast reports cannot be overstated. By providing insights into financial planning, effective cash flow management, risk mitigation, and investor confidence, these reports play a vital role in project success. Businesses that prioritize accurate cash flow forecasting set themselves up for smoother operations, better decision-making, and increased profitability. Embracing the power of cash flow forecast reports is a strategic move that ensures financial stability and paves the way for project triumph.